What is unique to responsible investment?

It is unavailable with certain asset classes like segregated fundi

B. ESG factors are standardized across the investment no industry.

C. A combination of a values and valuation-based approach to investing

D. It bases investment decisions exclusively on environmental factors.

What is the mostcost-effectivechannel an investor can use to Invest in derivativeproducts?

Based on market capitalization. which sector of the SSP.'TSX Composite index has one of the highest weightings withinthe index?

What will happen ita country's central government is at risk of defaulting on its debt?

Which statutory right allowsa purchaser to caned their order if a prospectus has a misrepresentation?

Brice purchased a $10.000 real return bond. The bond has a 10-year term to maturity and an annual coupon of 5% paid semi-annually. If the Consumer Price index increases by 0.8% over the next six months, what is the amount of Brice's first coupon payment?

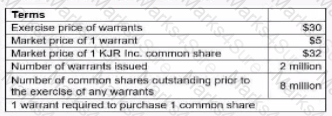

KJR made the following warrants offering:

What is the intrinsic value of 1 KJR inc, warrant?

An emerging Canadian company is exploring the possibility of using hotwater springs to produce clear energy forremote rural communities.The company has strong human resource capital and few assets, and raised SI 20,000 through the Capital Pool Company program. Which option is best for this company to continue maximizing public exposure and raising capital?

What is the difference between sinking funds and purchase funds concerning the redemption of bonds poor to maturity?

Which trend affecting the financialservices industry has resulted inthe significant use ETFs?

Which type of bond offers the investor a choice of interest payments in either of two currencies?

When sharesof GHI Inc. (GHI) traded at S50. aninvestor wrote five "GHI December 45" puts for a premium of $1,20. How much cash must the investor have in their account to be a cash-secured out writer?

A fixed-rate bond was originally priced at $100 and paid $5 per year in interest. Currently,the bond is trading at $102.75. What is the impact on the current yield of coupon of the bond as a result of the change in price?

A bond with a duration of five is currently priced at $103. If Interestrates rise by 2%. approximately what win be me bond's price?

An investor feels unfairly treatedby a stockbroker regarding a setof transactions. After a discussion of the situation Between the investor and the member, the investor and the member, the investor is still dissatisfied. What is the best requestthat the investor could make to seek compensation?

What is the impact of a stock split on the number of shares held by the shareholders and theirprice?

According to the Bankof Canada, approximately how many months does ittake for the effect of changes in monetary policy to be feltthrough the whole economy?

Which group is generally considered aprimary derivative dealer in the over-the-counter markets?

When a futures contract is entered into, who sets the minimum initial margin rate?

Who in a sell-side firm is responsible for structuring new debt issues and bringing them to the primary market?