An emerging Canadian company is exploring the possibility of using hot water springs to produce clear energy for remote rural communities. The company has strong human resource capital and few assets, and raised SI 20,000 through the Capital Pool Company program. Which option is best for this company to continue maximizing public exposure and raising capital?

What type of return is calculated for a security held for 18 months if no adjustments to the return are made?

Franco purchased an ETF in his non-registered account, and his total adjusted cost base in year 1 was $30,000. The ETF distributes income each year. And this reinvested distribution total was $1,750. The ETF also distributes a return of capital of $850. What would Franco’s total capital gain be if the sold the ETF for $39,000?

What is a characteristic of provincial savings bonds that distinguishes them from other provincial bonds?

How do the fees differ between an F-class and front-end version of the same fund?

Which type of commodity ETF is most suitable for an investor seeking to gain exposure to the spot price of a commodity?

A portfolio manager at an investment firm is analyzing the behavior of stocks in various market conditions. They believe markets are efficient and that all public and non-public and non-public available information is fully reflected in current process. How should the construct their investment portfolio?

Which regulatory body is responsible for the surveillance of trading and market-related activities of participants on Canadian equity marketplaces?

Which type of sell side equity revenue is earned when a dealer acts in thecapacity of an agent in clients trade?

In March of this year, a client buys 1,000 PIL inc, common shares at $16 per share and pays a commission of $25 on the purchase. Several months later in the same year, the client sell the shares at $12 per share and pays commission of $50 on the sale. What is the client’s allowable capital loss on the transaction?

Anwar is placing a market order to purchase 100 shares of AJL when the bid/ask is $10.25."$ 10.75. Before the trade is complete, the bid/ask moves to $10.207S1Q70. What is the share price that Anwar will pay on the purchase transaction?

What is the likely outcome at the end of a five-year term of a rate-reset preferred share if the issuer does not redeem the shares?

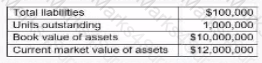

The following financial information is available for fund SKE:

What is SKE fund’s net asset value per share?

A fixed-rate bond was originally priced at $100 and paid $5 per year in interest. Currently, the bond is trading at $102.75. What is the impact on the current yield of coupon of the bond as a result of the change in price?

For institutional trading, when does the investor need to provide trade-matching elements?

How does asset-backed commercial paper (ABCP) differ from mortgage-backed securities?

The principle of retraction in retractable preferred shares is identical to what other security?