Payroll staff should be aware of all of the following potential warning signs of a data breach EXCEPT:

Under the FLSA, all of the following categories are defined as "white-collar" exemptions EXCEPT:

An employee hired on July 1, 2021, terminates employment on September 30, 2022. What is the earliest date the employer may dispose of the Form I-9?

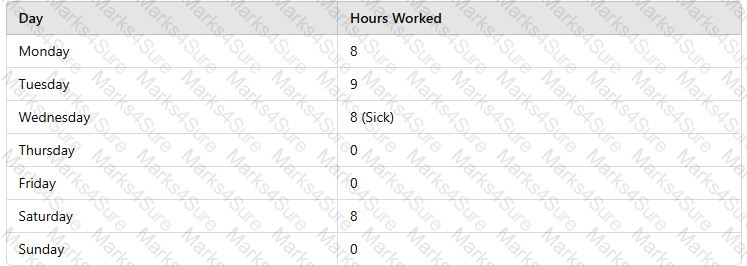

Using the following schedule for an employee who earns $9.00 per hour, calculate the overtime premium required under the FLSA.

When resolving late deposits, the payroll staff should take all of the following steps EXCEPT:

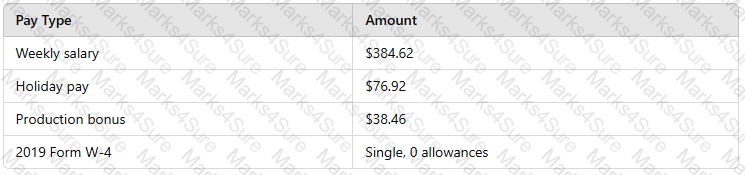

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

The reconciliation of an employee federal income tax withholding account occurs when which type of account is balanced?

The FLSA requires employers to retain employee work time schedules for at least:

Under theCCPA, use the following information to calculate theMAXIMUMdeduction for the child support order for an employee whois not supporting another family and not in arrears.

When an employer engages with a leasing company to lease an employee, the employer does NOT:

Which account type is used to classify accrued, but not yet taken, paid leave that is carried over from one year to the next?

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

Which of the following forms is used by an employer to file an annual return of withheld FIT from nonwage payments?

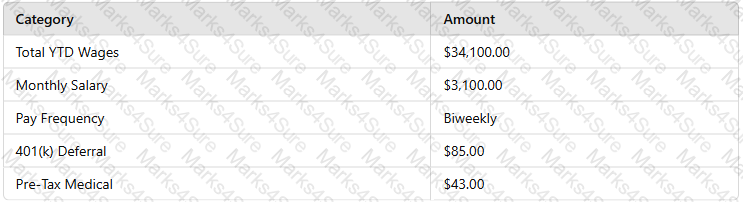

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

All of the following resources are available to help a Payroll Professional stay abreast of regulatory changes EXCEPT the:

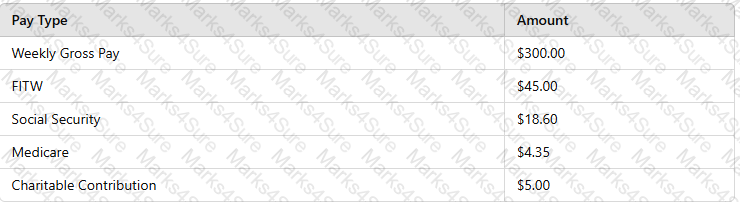

Using the following information from a payroll register, calculate the tax deposit liability for the payroll.

As of December 31, 2024, what is the MAXIMUM amount, if any, a 49-year-old employee can contribute to a 401(k) plan?

Which of the following general ledger accounts should normally maintain a credit balance?

Using the following information from a payroll journal, calculate the total Social Security tax liability for the first payroll of the year:

When an employee fails to cash a payroll check and the employer cannot locate the employee, the Payroll Department should:

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

All of the following objectives are included in the operations of a Payroll DepartmentEXCEPT:

Payroll standard operating procedures should be updated no less frequently than:

An employee's written notice of intent to take leave under the FMLA MUST be retained by the employer for a MINIMUM of:

Specifying a defined response time for an employee's payroll-related question is a component of a Payroll Department’s:

Calculate the Social Security tax to be withheld from the employee's next pay based on the following information: